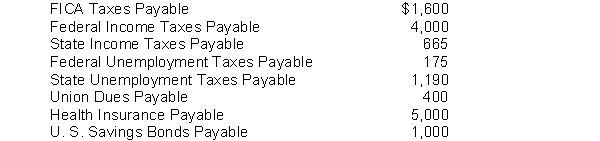

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Definitions:

Revenue Act of 1916

A United States federal law that aimed to increase tax revenues for the preparation of World War I, imposing an excess profits tax and increasing estate and income taxes.

Espionage Act

A United States federal law passed in 1917 that was designed to prevent the support of U.S. enemies during wartime, making it a crime to promote insubordination in the military or to interfere with military recruitment.

AFL

The American Federation of Labor, a national federation of labor unions in the United States founded in 1886, focusing on better wages, hours, and working conditions.

War Effort

The collective actions and resources of a nation or group of nations mobilized to support military operations during a time of war.

Q14: Barsuk Company began the year with stockholders'

Q20: Suppose you have a winning lottery ticket

Q25: All of the following are steps in

Q44: If a company adopts a new accounting

Q59: An accounting record of the balances of

Q101: Evidence that would not help with determining

Q106: Under the cost method, dividends received from

Q107: David Company borrowed $550,000 on December 31,

Q167: Which of the following is the correct

Q191: The transactions of Medina Information Service are