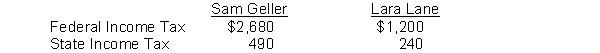

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows:

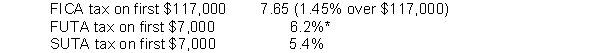

The following payroll tax rates are applicable:

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

Definitions:

Slave and Free States

Terms referring to U.S. states before the Civil War, denoting whether they permitted slavery ("slave states") or prohibited it ("free states").

Upper and Lower South

Terms used to differentiate between the geographical regions of the American South, with the Upper South referring to states like Virginia and Tennessee, and the Lower South to states such as Georgia and Alabama.

Slave-Owning Class

A social class in historical contexts, particularly in the American South, that owned slaves as property for labor and economic gain.

Paternalist Ethos

A belief system advocating a hierarchical relationship between groups or individuals, whereby those in authority adopt a fatherly role of providing for and directing those under their care.

Q9: The reference column of the accounts in

Q14: Assuming a FICA tax rate of 7.65%

Q28: The state unemployment tax rate is usually

Q83: Cross-footing a cash receipts journal means<br>A) the

Q91: Stockholders' equity is increased by<br>A) dividends.<br>B) revenues.<br>C)

Q100: Beethoven Company provided consulting services and billed

Q114: Georgia deposits $4,000 every three months for

Q133: Prepare an income statement, a retained

Q160: Owners enjoy limited liability in a<br>A) proprietorship.<br>B)

Q169: Barcelona Company owns 40% interest in the