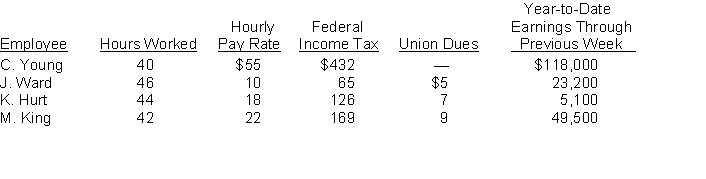

Assume that the payroll records of Erroll Oil Company provided the following information for the weekly payroll ended November 30, 2018.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

Definitions:

AGI Limitations

Thresholds based on Adjusted Gross Income that limit eligibility for certain tax deductions and credits.

AGI

Adjusted Gross Income; an individual's total gross income minus specific deductions, used to determine taxable income on a federal tax return.

Single

A filing status for unmarried taxpayers who do not qualify for any other filing status on their tax return.

American Opportunity Tax Credit

A refund for allowable educational fees paid for a qualifying scholar during their first four years of advanced education.

Q1: An analysis of the transactions made by

Q7: Transactions that cannot be entered in a

Q8: A journal provides<br>A) the balances for each

Q22: Under the cost method of accounting for

Q36: Transaction amounts recorded in the general journal

Q37: On January 2, 2016, Christopher inherited a

Q106: The final step in solving an ethical

Q124: Which of the following is the proper

Q160: Owners enjoy limited liability in a<br>A) proprietorship.<br>B)

Q167: Which of the following is the correct