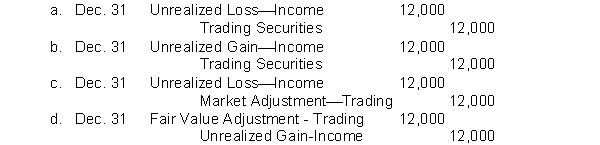

Cost and fair value data for the trading debt securities of Beltway Company at December 31, 2017, are $100,000 and $88,000, respectively. Which of the following correctly presents the adjusting journal entry to record the securities at fair value?

Definitions:

Multiple R

Represents a measure of the correlation between observed and predicted values of a variable in multiple regression analysis, indicating the strength and direction of a linear relationship.

Autocorrelation

A measure of how correlated a variable is with itself over successive time intervals, often used in time series analysis.

Significance F

A statistical measure used in the analysis of variance (ANOVA) to determine the likelihood that the observed differences among group means occur by chance.

Null Hypothesis

A statistical hypothesis that suggests there is no significant difference between specified populations or no effect.

Q3: Your friend is in business and wants

Q9: The amount of the lease obligation that

Q19: Margaret Company purchased equipment on January 1,

Q46: Match the following external users of financial

Q54: Evidence that the monthly posting of the

Q71: When changing from LIFO to FIFO, the

Q102: Which statement is false?<br>A) Salaries expense +

Q111: Refer to Exhibit 20-1. What would be

Q133: Prepare an income statement, a retained

Q195: Mazzeo Company acquires 80 Dodd's 10%, 5