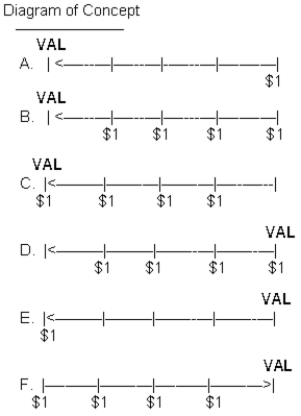

Match the diagrams with the concepts by writing the identifying letter of the diagram on the blank line to the left of the concept. "VAL" represents the value to be calculated.  Concept

Concept

___ 1. Future value of $1

___ 2. Present value of $1

___ 3. Future value of an annuity due of $1

___ 4. Future value of an ordinary annuity of $1

___ 5. Present value of an ordinary annuity of $1

___ 6. Present value of an annuity due of $1

Definitions:

Disclosures

A requirement for companies to present all relevant financial and operational information in their financial reports to ensure transparency and fairness.

Carrying Value

The book value of assets and liabilities reported on the balance sheet, considering factors like depreciation or amortization.

Amortized Cost

Amortized cost is the initial investment amount of a financial asset or liability adjusted for principal repayments, plus or minus the cumulative amortization of any difference between the initial amount and the maturity amount, and reduced by any potential impairment or uncollectibility.

Unrealized Holding

Unrealized holding refers to the increase or decrease in the value of an investment that has not yet been sold by the holder and thus, any potential gain or loss is not yet recognized in the financial statements.

Q31: Special journals are used to record unique

Q35: In a direct-financing lease, the guaranteed residual

Q36: Every correction of an error that requires

Q36: Which of the following would not be

Q37: When a lessor receives cash on an

Q60: In accounting for debit investments, companies make

Q67: The statement of cash flows classifies cash

Q98: Stacey has $5,000,000 on deposit in a

Q113: The future value of an annuity due

Q141: Currently on January 1, 2017), Nolan wants