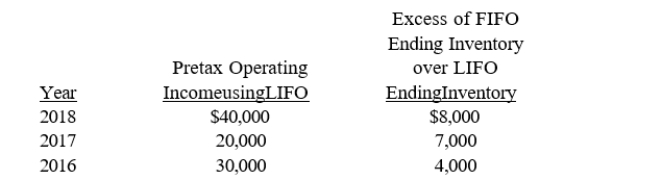

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2018. The following data were available:  The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2017-2018 comparative financial statements.

a. What is net income for 2018?

b. What is restated net income for 2017?

c. Prepare the 2017 statement of retained earnings as it would appear in the comparative

2017-2018 financial statements.

Definitions:

Market Baskets

A collection of goods and services used to represent consumption patterns for economic analysis.

Total Utility

The cumulative satisfaction or pleasure a consumer derives from consuming a certain quantity of goods and services.

Utility

An indicator of the joy or contentment a buyer experiences from the consumption of products and services.

Indifference Curve

A graph that shows a combination of two goods that give a consumer equal satisfaction and utility, illustrating their preferences.

Q43: Which of the following items would not

Q46: The future value of a single amount

Q50: In June 2011, the IASB amended IAS

Q71: In 2016, the Ballaster Company decided to

Q88: What are the four steps necessary to

Q91: Which one of the following would require

Q96: Refer to Exhibit 18-1. The entry to

Q99: Which of the following is not an

Q104: Using the table approach, the future amount

Q173: King George Company has these data at