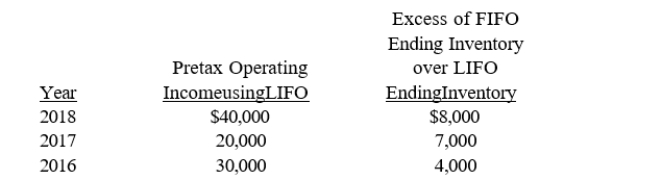

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2018. The following data were available:  The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2017-2018 comparative financial statements.

a. What is net income for 2018?

b. What is restated net income for 2017?

c. Prepare the 2017 statement of retained earnings as it would appear in the comparative

2017-2018 financial statements.

Definitions:

Equilibrium Price

The cost where the supply of goods meets the demand for those goods.

Tax Revenues

The funds collected by governments through the process of levying taxes.

Point Elasticity

The measure of how much the quantity demanded of a good responds to a change in price at a specific point on the demand curve.

Producer Surplus

The difference between the amount a producer is paid for a good and the minimum amount they are willing to accept for producing it.

Q2: When preparing a statement of cash flows

Q7: The process of determining the present value

Q13: One type of post-retirement benefit other than

Q31: If $100,000 is invested on December 31,

Q81: Smyrna Company had financial and taxable incomes

Q90: What four alternative methods for accounting for

Q90: Hardin Park Company had these transactions pertaining

Q92: The following information relates to the Fowler

Q94: Which of these three characteristics I, II,

Q112: On January 1, 2016, Mark Company leased