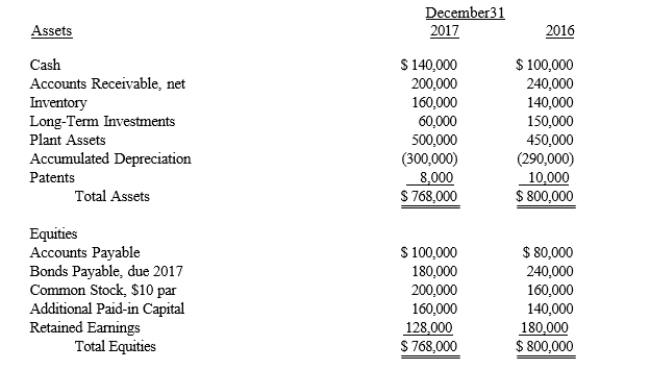

Exhibit 21-3

The Travis Company uses the spreadsheet method for completing the statement of cash flows. The balance sheet accounts and other information related to those accounts are presented below for Travis Company:  Additional information related to 2017 activities:

Additional information related to 2017 activities:

Additional information related to 2017 activities:

1. Net loss for 2017 was $40,000.

2. Cash dividends of $12,000 were declared and paid in 2017.

3. 4,000 shares of common stock were issued to bondholders converting bonds payable into common stock.

4. A long-term investment was sold for $100,000 cash.

5. Equipment costing $100,000 and having accumulated depreciation of $30,000 was sold for

$50,000 cash.

-Refer to Exhibit 21-3. Net cash provided used) in the operating activities section of Travis's 2017 statement of cash flows was

Definitions:

Operating Activities

Activities directly related to the operation of the business, including production, sales, and day-to-day business management.

FASB

The Financial Accounting Standards Board is an independent organization responsible for establishing and improving financial accounting and reporting standards in the United States.

Cost-Benefit Constraint

An accounting principle that suggests weighing the cost of providing financial information against the potential benefit that information offers to users.

Cash Paid

The amount of money disbursed by a business for various purposes, including operating expenses, investments, and financing activities.

Q5: A change in a reporting entity is

Q12: If a pension plan amendment is adopted

Q18: The expense for other postretirement benefits, such

Q41: A simple capital structure is one that

Q51: The Fair Value Adjustment account is a(n)<br>A)

Q58: Fairfax Company had a balance in Deferred

Q65: The following is a list of items

Q80: Moore Company reported the following operating

Q93: During a year-end evaluation of the financial

Q95: The present value of an annuity is