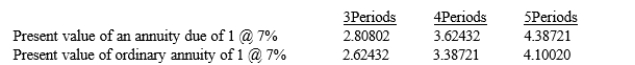

On January 1, 2016, Watson Company signed a four-year lease requiring annual payments of $45,000, with the first payment due on January 1, 2016. Watson's incremental borrowing rate was 7%. Actuarial information for 7% follows:

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2016 rounded to the nearest dollar) ?

Definitions:

Government Control

The extent to which a government uses its authority to regulate and direct economic operations, policy-making, and society.

Collective Bargaining

The process of negotiation between employers and a group of employees aimed at agreements to regulate working salaries, working conditions, benefits, and other aspects of workers' compensation and rights.

Labor Relations

The study and practice of managing relationships between employers and their workforce, focusing on negotiation and administration of collective bargaining agreements.

Nordic Countries

A geographical and cultural region in Northern Europe and the North Atlantic, consisting of Denmark, Finland, Iceland, Norway, and Sweden.

Q11: Refer to Exhibit 21-2. The Cash Flows

Q18: Beare Company claims a $2,000,000 R&D tax

Q25: Corporations with complex capital structures are required

Q48: In calculating earnings per share, a company

Q49: On April 1, 2016, Meyers Company purchased

Q51: From the lessee's viewpoint, which of the

Q56: Refer to Exhibit 22-2. what is the

Q84: On November 1, 2016, the Cranberry Construction

Q85: When a contract contains an uncertain, variable

Q115: Anchorby Company, an equipment manufacturer, leases equipment