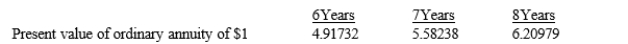

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

Definitions:

Comma Usage

The set of rules that governs the use of commas to separate elements in sentences, clarifying meaning and indicating pauses.

Gas Mask

A protective mask used to cover the face to filter out toxic gases and protect the wearer from inhaling harmful substances.

Explosion

A sudden and violent release of energy that creates a loud noise and often destruction.

Comma Usage

The application of commas in written text to clarify meaning, separate elements, or indicate a pause.

Q14: The _ of a long-term note or

Q36: A _is an explicit or implicit promise

Q55: A corporation's deferred tax expense or benefit

Q72: What is a restriction of retained earnings

Q76: What five components comprise pension expense?

Q89: Other Comprehensive Income or loss might include

Q91: An advantage of retrospective adjustment method is

Q104: A company determines whether to recognize an

Q126: What is the formula for the

Q128: A corporation whose stock is traded on