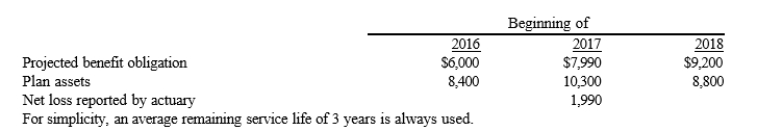

Teresa Company had the following information related to its pension plan:  An additional net loss of $1,990 was reported as of January 1, 2017 see table). This amount has been included in the

An additional net loss of $1,990 was reported as of January 1, 2017 see table). This amount has been included in the

January 1, 2017, projected benefit obligation balance.

Required:

Compute the amount of loss that should be included in pension expense in:

a. 2017

b. 2018

Definitions:

Overhead Applied

The process of allocating estimated overhead costs to individual products or job orders based on a predetermined rate or method.

Estimated Total Manufacturing Overhead

The projected total costs associated with the manufacturing process that are not directly tied to the production of goods.

Estimated Total Manufacturing Overhead

The anticipated total costs associated with the manufacturing process, excluding direct materials and direct labor.

Plantwide Predetermined Manufacturing Overhead Rate

A single overhead absorption rate calculated for an entire factory, used to allocate manufacturing overhead costs to products.

Q7: GAAP states that a change in accounting

Q17: Jennifer, Inc. entered into a five-year capital

Q49: Refer to Exhibit 22-6. By how much

Q54: Noncash consideration should be recognized by the

Q74: Benefits for which the employee's right to

Q74: The Wyatt Company reports the following for

Q91: How should the sale of a depreciable

Q103: Which statement best reflects the issues associated

Q107: David Company borrowed $550,000 on December 31,

Q140: What characteristics may be specified in the