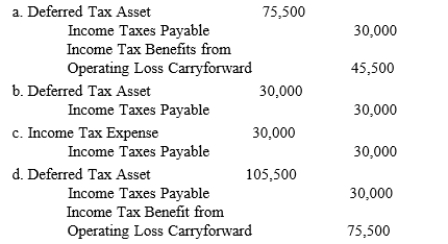

At the end of its first year of operations on December 31, 2016, the Brandon Company reported taxable income of $100,000 and had a pretax financial loss of $60,000. Differences between taxable income and pretax financial income included interest revenue received from municipal obligations of $20,000 and warranty expense accruals of

$180,000. Warranty expenses of $90,000 are expected to be paid in 2017 and $110,000 in 2018. The enacted income tax rates for 2016, 2017, and 2018 are 30%, 35%, and 40%, respectively. The journal entry to record income tax expense on December 31, 2016, would be

Definitions:

Case Opener

A tool or device designed to open protective casings, commonly associated with packaging or equipment maintenance.

Privilege

A special right, advantage, or immunity granted to a particular person or group.

Commercial Insurance

is a type of insurance designed to protect businesses from losses due to events that may occur during the normal course of business, such as property damage or liability claims.

Business Risk

The potential for losses or less-than-expected returns stemming from the economic, industry, or company-specific factors.

Q6: GAAP requires the borrowers to record the

Q15: On January 1, 2016, Madison Company signed

Q33: On January 1, 2017, Carly Fashions Inc.

Q37: When a lessor receives cash on an

Q59: When is it appropriate for the lessee

Q72: Other postretirement benefits are provided to former

Q96: Disclosure of a retrospective adjustment should include<br>A)

Q146: An open corporation does not allow the

Q150: Discount on Bonds Payable is an)<br>A) contra

Q184: Refer to Exhibit 14-4. At date of