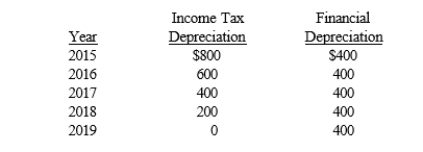

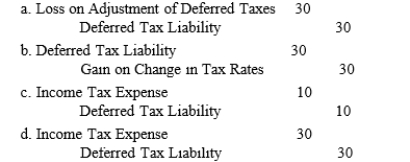

Pruett Corporation began operations in 2015 and appropriately recorded a deferred tax liability at the end of 2015 and 2016 based on the following depreciation temporary differences between pretax financial income and taxable income:  The income tax rate for 2015 and 2016 was 30%. In February 2017, due to budget constraints, Congress enacted an income tax rate of 35%. What is the journal entry required to adjust the Deferred Tax Liability account in February 2017?

The income tax rate for 2015 and 2016 was 30%. In February 2017, due to budget constraints, Congress enacted an income tax rate of 35%. What is the journal entry required to adjust the Deferred Tax Liability account in February 2017?

Definitions:

Freud

Sigmund Freud was an Austrian neurologist and the founder of psychoanalysis, a clinical method for treating psychopathology through dialogue between a patient and a psychoanalyst.

Psychoanalytic Method

A clinical method for treating psychopathology by exploring the unconscious mind, employing techniques like dream analysis and free association.

Childhood

The period of a person's life when they are a child, encompassing both physiological growth and psychological development stages.

Rejection

The act of dismissing or refusing a proposal, idea, or individual.

Q2: To improve usefulness of defined pension plans,

Q4: Robertson Company had 40,000 shares of common

Q24: Combining the net deferred tax asset and

Q56: On January 1, 2016, Samuel Company had

Q59: When preparing a statement of cash flows

Q74: Under IFRS, a company is allowed to

Q82: Two were expected to retire at the

Q94: Permanent differences between pretax financial income and

Q106: The denominator in the calculation for the

Q122: When a company sells bonds between interest