During its first year of operations ending on December 31, 2016, the Dakota Company reported pretax accounting income of $600,000. The only difference between taxable income and accounting income was $80,000 of accrued warranty costs. These warranty costs are expected to be paid as follows:  Assuming an income tax rate of 30% in 2016, what amount of income tax expense should Dakota report on its 2016 income statement?

Assuming an income tax rate of 30% in 2016, what amount of income tax expense should Dakota report on its 2016 income statement?

Definitions:

Predisposition

An inclination or tendency to think, feel, or act in a particular way.

Unethical

Unethical refers to actions or behavior that violate moral principles or professional standards, often causing harm or unfair outcomes.

Moral Development

The process through which individuals grow in their understanding of moral concepts, including the differentiation between right and wrong.

Ethical Decisions

Choices made based on moral principles and values, aiming to do what is right and fair in a given situation, especially when faced with complex dilemmas.

Q7: A lease must be treated as a

Q10: Major Corporation had 50,000 shares of common

Q15: The nominal rate is greater than the

Q23: For a lease that contains a bargain

Q34: Using accelerated depreciation for tax purposes and

Q40: In addition to providing pensions to their

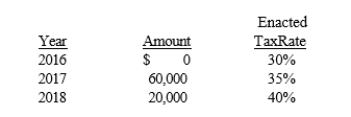

Q63: The Jack Company began its operations on

Q97: Describe the two types of corporate capital

Q100: Refer to Exhibit 17-2. Assuming the performance

Q117: The Opal Company was incorporated and