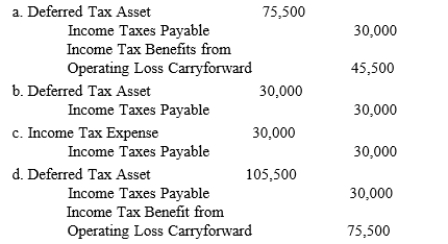

At the end of its first year of operations on December 31, 2016, the Brandon Company reported taxable income of $100,000 and had a pretax financial loss of $60,000. Differences between taxable income and pretax financial income included interest revenue received from municipal obligations of $20,000 and warranty expense accruals of

$180,000. Warranty expenses of $90,000 are expected to be paid in 2017 and $110,000 in 2018. The enacted income tax rates for 2016, 2017, and 2018 are 30%, 35%, and 40%, respectively. The journal entry to record income tax expense on December 31, 2016, would be

Definitions:

Flow Variable

An economic measurement that describes quantities which are measured over a specified period of time, such as income, expenses, or investment.

Foreign Currency Reserve

Refers to the foreign currencies held by a central bank or a monetary authority, used to support its liabilities, stabilize its currency, and finance trade imbalances.

Income

The money received, especially on a regular basis, for work or through investments.

Opportunity Cost

The price paid for not choosing the next most favorable option when deciding or picking between different possibilities.

Q2: On July 15, Zink Jewels agrees to

Q5: Refer to Exhibit 15-7. The compensation expense

Q7: A lease must be treated as a

Q10: If a contract involves a significant financing

Q27: A contract may be written, oral, or

Q28: On January 1, 2004, Zonal Company leased

Q36: The account balance information for Miller Company

Q74: If a sales-type lease is renewed at

Q91: The legal capital of a corporation may

Q148: Which of the following characteristics of a