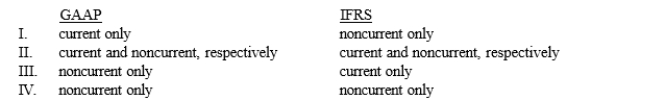

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

Definitions:

Linkage

The connection or relationship between two or more factors, objects, or systems.

Period Costs

Expenses that are not directly tied to the production of goods and are expensed in the period they are incurred.

Individual Sales

Individual Sales refer to transactions and revenue generated from selling products or services on a per-unit or single-transaction basis.

Matching Principle

An accounting principle that requires expenses to be matched with the revenues they help to generate in the same accounting period.

Q3: Vested benefits are<br>A) estimated benefits.<br>B) benefits to

Q4: On April 1, 2013, Bond Corporation issued

Q23: The effective interest method of amortization assumes

Q26: On July 10, Boogie Footware agrees to

Q28: Several errors are listed below. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6930/.jpg"

Q32: Revenues represent<br>A) increases in assets and/or decreases

Q48: On the statement of cash flows prepared

Q62: The visual inspection method is used when

Q67: Refer to Exhibit 17-1. What amount of

Q87: What is the basic earnings per share