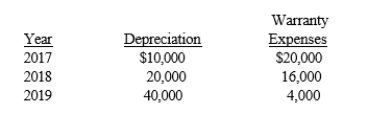

Delmarva Company, during its first year of operations in 2016, reported taxable income of $170,000 and pretax financial income of $100,000. The difference between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows:  Enacted tax rates are 30% for 2016, 35% for 2017 and 2018, and 40% for 2019.

Enacted tax rates are 30% for 2016, 35% for 2017 and 2018, and 40% for 2019.

Required:

Prepare the income tax journal entry for Delmarva Company for December 31, 2016.

Definitions:

Place and Condition

Terms used to refer to the physical location and state of goods in a transaction, affecting their valuation and delivery responsibilities.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating the efficiency of a company in managing its production and labor costs.

Inventory Valuation

A method used to calculate the cost of goods sold and the end inventory balance, involving techniques such as FIFO, LIFO, and weighted average cost.

Consignor

A person or company that sends goods to a consignee to be sold or returned, retaining ownership until sale.

Q33: Gage began a defined benefit pension plan

Q38: A company must fund its pension plan

Q54: Current GAAP regarding employers' accounting for defined

Q58: On January 1, 2016, Dawn Company bought

Q63: When existing corporations issue stock, costs such

Q64: During 2016, Sanders, Inc. had the following

Q87: Explain the direct and indirect effects of

Q96: Refer to Exhibit 18-1. The entry to

Q120: Refer to Exhibit 14-8. The net liability

Q183: Which of the following statements is false?<br>A)