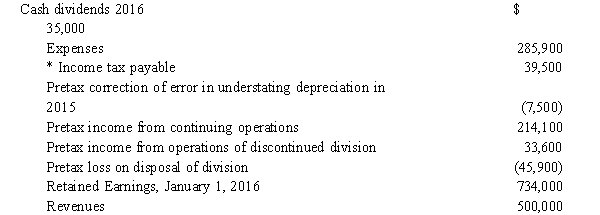

The following information relates to the Kill Devil Hills Company for the year ending December 31, 2016:  * Of this amount $4,800 relates to the pretax income from the operations of discontinued division; pretax loss on the

* Of this amount $4,800 relates to the pretax income from the operations of discontinued division; pretax loss on the

disposal of division resulted in a tax savings of $13,350; and pretax correction of the depreciation error resulted in a tax savings of $1,500.

Required:

1) Prepare the year end journal entry necessary to record the 2016 intraperiod income tax allocation.

2) Prepare Kill Devil Hill's 2016 income statement and statement of retained earnings.

Definitions:

Supplement Talents

To add or enhance skills and abilities in addition to what is already possessed, often through training or recruitment.

Online Stakeholders

Individuals or groups with an interest or concern in an online business or project, including customers, partners, and employees.

Brand Socialization

The process through which individuals learn about and adopt the values, behaviors, and practices associated with a brand.

Reputation Analysis

The process of evaluating the public perception or image of a person, company, or brand.

Q4: A corporation acquired a copyright by issuing

Q10: Refer to Exhibit 15-8. What is the

Q15: Refer to Exhibit 15-2. The initial entry

Q37: On January 1, 2016, Nelson Company gave

Q48: In calculating earnings per share, a company

Q50: What type of account is Partial Billings?<br>A)

Q66: Accounting for prior service cost prospectively would

Q78: Meagan Co. has the following errors on

Q108: Refer to Exhibit 20-1. What would be

Q147: A gain is earned when retiring bonds