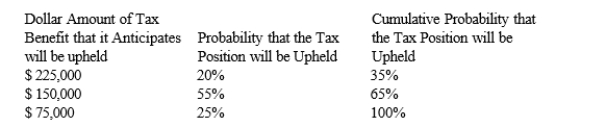

At the end of the current year, Brothers company claims a $225,000 tax credit on its income tax return. Brothers is uncertain about whether the IRS will accept the credit. After some research it is determined that the IRS may not accept all of the tax credit. Brothers estimates the likelihood using the following probability distribution:  Required:

Required:

For the current year determine:

1) the amount Brothers will be able to recognize as a current tax benefit

2) the amount that will be record as the unrecognized tax benefit.

Definitions:

Excludable

A characteristic of a good or service that means it is possible to prevent people who have not paid for it from having access to it.

National Defense

The protection and defense of a country's interests, territories, and citizens, usually handled by the military and defense agencies.

Consumption

The act of using goods and services to satisfy human wants or needs, a primary activity analyzed in consumer behavior and economics.

Marginal Social Benefit

The additional benefit to society that results from producing one more unit of a good or service.

Q14: Current GAAP requires that the net gain

Q25: A corporation is a legal entity<br>A) held

Q31: Postemployment benefits are provided to former employees<br>A)

Q41: Martian Magic issued 800 shares of $50

Q49: Refer to Exhibit 14-7. The entry to

Q57: For the year ended December 31, 2016,

Q113: Budget Leasing issued 500 shares of $20

Q121: Wally, Inc. issued 500 shares of $10

Q149: Which of the following statements concerning treasury

Q178: Bond interest expense is calculated as the