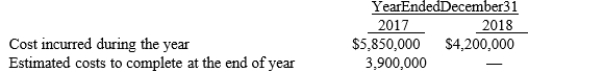

In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this contract:  Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

Definitions:

Self-serving Rationalizations

Justifications an individual creates to defend actions or decisions that serve their own interests, often at the expense of truth.

True Intentions

The genuine or actual motivations and goals behind an individual's or group's actions, often as contrasted with stated or apparent objectives.

Alternatives

Refers to the various options or choices available to individuals or organizations when faced with making a decision.

Propensity

A natural inclination or tendency to behave in a particular way.

Q7: What are the advantages of qualified pension

Q9: The amount of the lease obligation that

Q12: There is disagreement among accountants as to

Q46: The FASB and the IASB jointly issued

Q52: The FASB provides a 4-step model for

Q52: Norwalk Corporation issued 10,000 shares of $50

Q75: On January 1, Maxine Corp. entered into

Q122: Refer to Exhibit 15-1. Assume the sale

Q148: When retiring treasury stock, retained earnings could

Q171: Premium on Bonds Payable is a contra