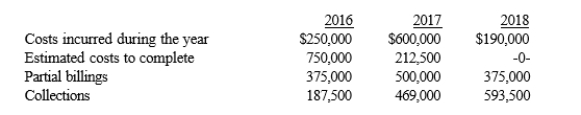

Thompson Construction began a construction project in 2016. The contract price was $1,250,000, and the estimated costs were $1,000,000. Data for each year of the contract are as follows:

Required:

Assuming Thompson satisfies its performance obligation over time, determine: 1) The balance of Construction in Progress at the end of 2016.

2) How the net amount for construction in progress inventory should be reported on the

2017 balance sheet.

3) The gross profit for 2018.

Definitions:

Comparative Advantage

The ability of an individual, firm, or country to produce a good or service at a lower opportunity cost than others.

Trade

Trade involves the exchange of goods or services between parties, which can be within a country or between countries.

Resources

Economic or productive factors required to accomplish an activity, or to provide a service or product, such as land, labor, and capital.

Opportunity Cost

The loss of potential gain from other alternatives when one alternative is chosen; the value of the next best alternative foregone.

Q7: What are the advantages of qualified pension

Q15: Differences exist between IFRS and GAAP in

Q18: Refer to Exhibit 15-6. In 2017, the

Q29: Refer to Exhibit 15-8. What is the

Q55: What is the primary purpose of the

Q66: A company should only apply the revenue

Q72: Revenue from installment sales is recognized in

Q91: Nonrefundable fees from customers are recognized as

Q115: List three reasons a company might call

Q163: The assumption of a stable interest expense