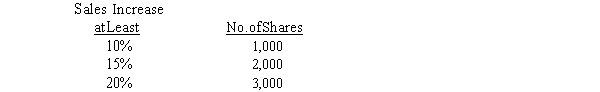

On January 1, 2016, Biggs Company granted a performance-based stock option plan to 40 executives to buy a maximum of 3,000 shares each of its $10 par common stock at $30 a share. The fair value per option is $8. The terms of the plan, which has a three-year service and vesting period, are based on the following scale:

Biggs expects an annual employee turnover rate of 3%, and the company initially anticipates an increase in sales during the service period of 18%. By the end of 2019, the actual sales increase is 17%.

Required:

a. Compute the estimated total compensation cost.

b. Compute the annual compensation expense for each of the three years.

c. Prepare the January 1, 2016, entry when 10 executives exercise their options.

Definitions:

Vacation Time

Paid or unpaid time off work granted by employers to employees for leisure and rest.

Observed Holidays

Public or private holidays recognized and celebrated by a society, often with official status.

Performance Evaluations

Assessments of an employee's work performance, typically conducted on a regular basis to determine areas of improvement and to facilitate growth and development.

Raises

Typically refers to an increase in salary or wages provided to an employee by an employer.

Q3: On January 1, 2016, Kiper Corporation had

Q4: A corporation acquired a copyright by issuing

Q31: Briefly describe the four major differences between

Q57: The preference to dividends that preferred shareholders

Q82: A copyright is granted by the federal

Q84: Refer to Exhibit 13-03. What amount would

Q87: Refer to Exhibit 14-8. The balance of

Q110: In a matched swap, the actual loan

Q116: Trademarks are considered to have an indefinite

Q158: Refer to Exhibit 14-16. Harry's total liabilities