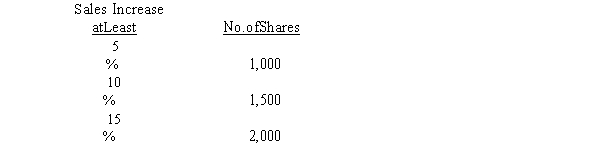

On January 1, 2016, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan 2016 through 2020).

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal installments.

Mutually Exclusive

A statistical term describing two or more events that cannot occur simultaneously.

Salvage Value

The estimated residual value of an asset at the end of its useful life, important for depreciation calculations.

Internal Rate Of Return (IRR)

The discount rate that makes the NPV of an investment zero.

Q1: Advance Medical Imaging, Inc. reacquired 2,000 shares

Q11: On January 3, 2017, Nancy Corporation purchased

Q51: On January 1, 2015, Leslie Co. issued

Q75: On January 1, Maxine Corp. entered into

Q81: Under the par value method of accounting

Q97: Define the following:<br>*Held-to-Maturity Securities<br>*Trading Securities<br>*Available-for-Sale Securities

Q114: When callable preferred stock is recalled, if

Q123: Significant influence of another company generally occurs

Q131: How is Paid-in Capital from Share Options

Q144: Refer to Exhibit 14-12. Which of the