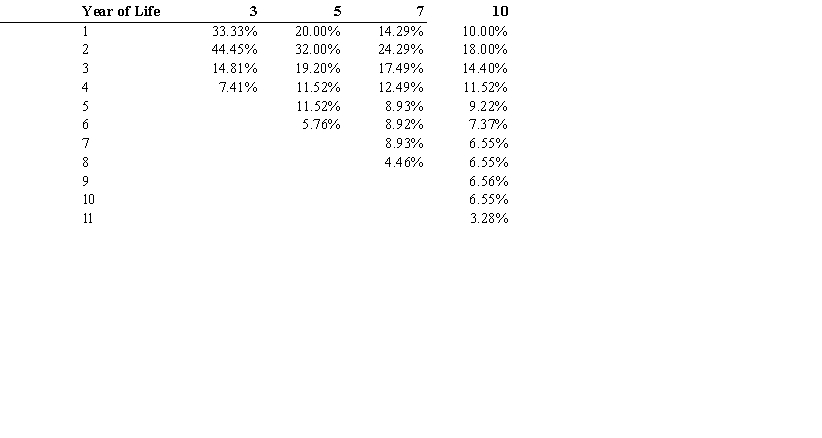

Exhibit 11-05

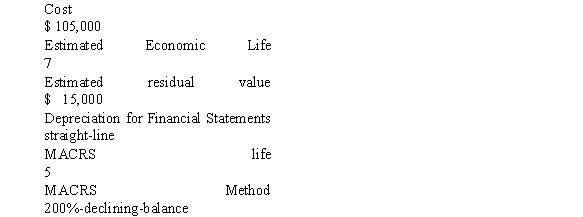

Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, Year 1.

MACRS Depreciation as a Percentage of the Cost of the Asset

-Refer to Exhibit 11-05, what amount of depreciation would be recorded on the income tax returns for year 5?

Definitions:

Balance Per Bank

The ending cash balance in a company's bank account as per the bank's records.

Credit Memo

A document issued by a seller to a buyer, reducing the amount the buyer owes to the seller, typically due to a return or refund.

Short-Term Note

A promissory note due for repayment within a short period, typically less than a year, used by companies to manage cash flow or secure short-term financing.

Company's Records

Documentation that encompasses all the financial transactions, agreements, and obligations of a business.

Q2: When a company issues a long-term non-interest-bearing

Q13: Maxa Marina exchanged a boat with a

Q45: How should a company treat the issuance

Q50: Texas Company has a $4,000,000, 8% bank

Q53: Refer to Exhibit 7-5. The ending inventory

Q62: Investments in debt and equity securities that

Q74: Assume that a company is facing a

Q109: Albert Corp. introduced a new machine on

Q145: When a company issues bonds, the selling

Q176: How do the classification requirements of IFRS