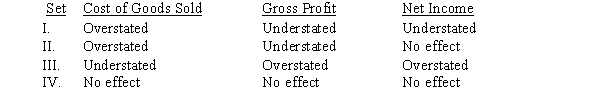

The accountant for Suzanne Company made the following errors related to inventory in 2017:

1) The beginning inventory for 2017 was overstated by $1,375 due to an error in the physical count.

2) A $1,650 purchase of merchandise on credit in 2017 was not recorded or included in the ending inventory.

Assuming a periodic inventory system, how would Sue's cost of goods sold, gross profit, and net income be affected in 2017 by these errors?

Definitions:

Assigns

Individuals or entities to whom rights or properties are legally transferred.

Landlord's Consent

Permission given by a landlord, often required for specific actions by a tenant, such as subletting or altering the property.

Exclusive Right

A legal provision granting a party sole permission to use, produce, or sell a particular product or service.

Possession

The act of having or controlling something, either physically or legally.

Q12: The old forklift was purchased for $20,000

Q27: All of the following are included in

Q36: Under the dollar-value LIFO the cost-to-retail ratio

Q64: A farmer donated a large tract of

Q65: Morris recently purchased a building and the

Q89: Refer to Exhibit 11-04, what amount of

Q120: Which is not a characteristic of a

Q124: The Chuck Company purchased a truck on

Q126: Hill has a fiscal year-end of December

Q170: To classify a receivable as a current