The following are transactions of the Morrison Company:

a. On November 5, sold merchandise on account for $46,000 with terms of 3/15, n/30.

b. On November 20, payment was received on $32,000 worth of merchandise sold on November 5.

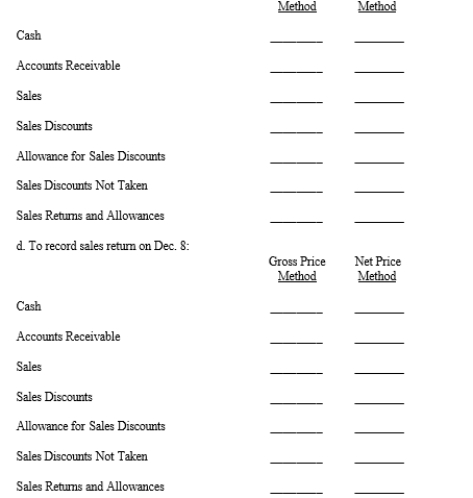

c. On December 5, further collections were made on $8,000 of merchandise sold on November 5.

d. On December 8, merchandise sold for $4,000 on November 5 was returned by the purchaser and credit was granted by Morrison Company.

Required:

Consider the journal entry required for each transaction a-d. In the spaces below, record the appropriate dollar amounts to be debited or credited on the appropriate line for each account under the gross price and net price methods.. Indicate that the amount is a debit or credit by placing a Dr) or Cr) after the amount. Leave spaces blank for any accounts NOT affected by a transaction.

Definitions:

Working Lifetime

The period in an individual's life during which they are active in the workforce, contributing labor in exchange for income.

Present Value

The current worth of a future sum of money or stream of cash flows, given a specific rate of return.

Income Loss

A reduction in the amount of income generated or received.

Full-Ride Scholarship

A type of scholarship that covers all of a student's tuition, fees, and possibly living expenses for the duration of their studies.

Q8: Three phases of the convergence project were

Q15: Which of the following inventory cost flow

Q21: The entire group of accounts for a

Q33: The tax rate is not determined until

Q49: Gain contingencies should<br>A) be accrued if they

Q83: Expenses are recognized and matched against revenues

Q106: The use of dollar-value LIFO follows the

Q110: Which of the following would not be

Q137: What three conditions must be met for

Q171: Below is a list of items. Classify