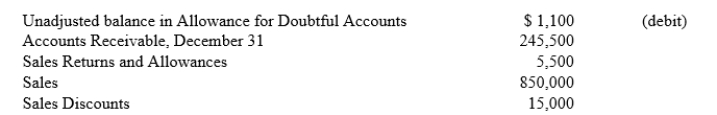

The following information is provided:  Required:

Required:

a. Prepare the adjusting entry if bad debts are estimated to be 1.5% of net sales.

b. Compute the amount of the adjusting entry if bad debts are estimated to be 3% of ending accounts receivable.

Definitions:

Looting

In corporation law, the transfer of a corporation’s assets to its managers or controlling shareholders at less than fair value.

Debt-To-Equity Ratio

A financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets.

Corporate Veil

A legal concept that separates the personality of a corporation from the personalities of its shareholders, and protects them from being personally liable for the company's debts and obligations.

Thin Capitalization

In corporation law, a ground for piercing the corporate veil due to the shareholders’ contributing too little capital to the corporation in relation to its needs.

Q6: Management of current liabilities arises, in part,

Q9: A purchase on credit is omitted from

Q37: From the list of accounts below determine

Q62: An advantage of basing bad debt expense

Q67: The primary objective if financial reporting is

Q70: In a period of rising prices what

Q74: Which one of the following is not

Q111: Information from the accounts of Gause Company

Q111: Which of the following statements does not

Q132: The Brad's Farm Company uses the retail