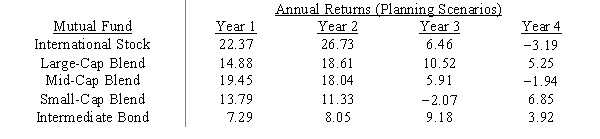

Portfolio manager Max Gaines needs to develop an investment portfolio for his clients who are willing to accept a moderate amount of risk. His task is to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the portfolio provides an annual return of no less than 3%. Formulate the appropriate linear program.

Definitions:

Interest Rate

The rate at which borrowers are charged for accessing assets, specified as a percentage of the original sum borrowed.

Desired Saving

The portion of income that households choose to save rather than spend on consumption.

Desired Investment

The level of investment that firms plan or wish to undertake based on their expectations of future economic conditions.

Interest Rate

The interest rate is the percentage charged on the total amount lent or paid on invested funds, typically expressed on an annual basis.

Q18: It is possible to have more than

Q24: We have a number of types of

Q29: Explain the differences between the LP formulations

Q41: The problem which deals with the distribution

Q42: Define three forms of models and provide

Q50: What is working capital and how does

Q51: Which Principle of the AICPA Code of

Q53: What is the term for the systematic

Q59: Information about a company's operating capability may

Q69: Find the maximal flow from node 1