John Sweeney is an investment advisor who is attempting to construct an "optimal portfolio" for a client who has $400,000 cash to invest. There are ten different investments, falling into four broad categories that John and his client have identified as potential candidates for this portfolio.

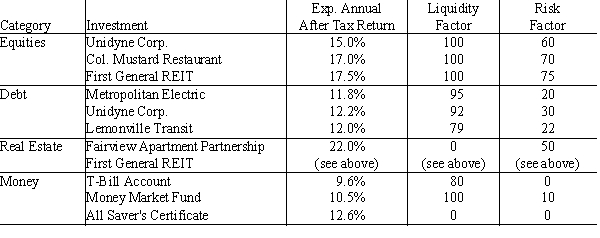

The following table lists the investments and their important characteristics. Note that Unidyde Equities (stocks) and Unidyde Debt (bonds) are two separate investments, whereas First General REIT is a single investment that is considered both an equities and a real estate investment.

Formulate and solve a linear program to accomplish John's objective as an investment advisor which is to construct a portfolio that maximizes his client's total expected after-tax return over the next year, subject to a number of constraints placed upon him by the client for the portfolio:

1.Its (weighted) average liquidity factor must be at least 65.

2.The (weighted) average risk factor must be no greater than 55.

3.At most, $60,000 is to be invested in Unidyde stocks or bonds.

4.No more than 40% of the investment can be in any one category except the money category.

5.No more than 20% of the investment can be in any one investment except the money market fund.

6.At least $1,000 must be invested in the money market fund.

7.The maximum investment in All Saver's Certificates is $15,000.

8.The minimum investment desired for debt is $90,000.

9.At least $10,000 must be placed in a T-Bill account.

Definitions:

Basic Traits

Fundamental personality characteristics that are relatively stable over time and across situations.

Personality

A unique combination of emotional, attitudinal, and behavioral response patterns of an individual, distinguishing one person from another.

Neuroticism

A personality trait characterized by sadness, moodiness, and emotional instability.

Divorce

The legal dissolution of a marriage by a court or other competent body.

Q7: The purpose of row operations is to

Q13: A balance sheet shows the<br>A) fair value

Q19: The minimal spanning tree algorithm will:<br>A) sometimes

Q19: Mountainside State Park has four visitor centers.

Q21: The residual interest in a company's assets

Q30: The ranges for which the right-hand side

Q52: The accounting equations is<br>A) Assets + Liabilities

Q56: In the general linear programming model of

Q74: Cross-sectional analysis is most closely associated with<br>A)

Q95: ABC Company entered into some relatively large