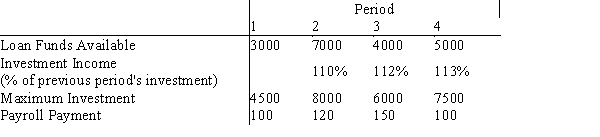

Information on a prospective investment for Wells Financial Services is given below.  In each period, funds available for investment come from two sources: loan funds and income from the previous period's investment. Expenses, or cash outflows, in each period must include repayment of the previous period's loan plus 8.5% interest, and the current payroll payment. In addition, to end the planning horizon, investment income from period 4 (at 110% of the investment) must be sufficient to cover the loan plus interest from period 4. The difference in these two quantities represents net income, and is to be maximized. How much should be borrowed and how much should be invested each period?

In each period, funds available for investment come from two sources: loan funds and income from the previous period's investment. Expenses, or cash outflows, in each period must include repayment of the previous period's loan plus 8.5% interest, and the current payroll payment. In addition, to end the planning horizon, investment income from period 4 (at 110% of the investment) must be sufficient to cover the loan plus interest from period 4. The difference in these two quantities represents net income, and is to be maximized. How much should be borrowed and how much should be invested each period?

Definitions:

Q5: John Sweeney is an investment advisor who

Q10: Solve the following problem graphically.<br>Max<br>5X + 6Y<br>s.t.<br>17X

Q16: Decision variables limit the degree to which

Q20: The reduced cost for a positive decision

Q21: A transition probability describes<br>A) the probability of

Q34: As long as the objective function coefficient

Q35: A critical activity can be part of

Q40: Consider the transportation problem below.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6979/.jpg"

Q41: The net evaluation index for occupied cells

Q121: Which of the following is not included