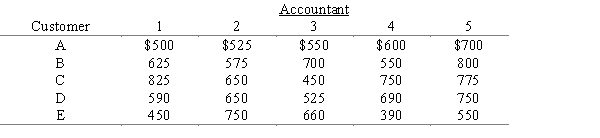

Five customers needing their tax returns prepared must be assigned to five tax accountants. The estimated profits for all possible assignments are shown below. Only one accountant can be assigned to a customer, and all customers' tax returns must be prepared. What should the customer-accountant assignments be so that estimated total profit is maximized? What is the resulting total profit?

Definitions:

Variable Expenses

Billing that adjusts based on the production volume or the number of sales, encompassing materials and labor expenses.

Business Segments

Distinct parts of a company that are engaged in different types of businesses, each of which may generate its own revenues and expenses.

Break-even Sales

The amount of revenue needed to be generated to cover all fixed and variable costs, indicating no profit or loss.

Wholesale Division

A division of a company that sells goods in large quantities to retailers, other distributors, or sometimes directly to consumers.

Q10: Compared to the problems in the textbook,

Q16: The Tots Toys Company is trying to

Q19: How is the assignment linear program different

Q20: The assignment problem is a special case

Q34: A waiting line situation where every customer

Q44: With fewer periods in a moving average,

Q50: If data for a time series analysis

Q55: Simulation<br>A) does not guarantee optimality.<br>B) is flexible

Q56: If the acceptance of project A is

Q63: Does the following linear programming problem exhibit