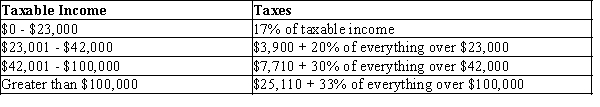

-Use the information provided in Exhibit 11-4.What is the marginal tax rate on the 23,000th of dollar of taxable income earned?

Definitions:

Net Sales

Sales revenue minus deductions for returns, allowances for damaged or missing items, and discounts.

Semiannually

Occurring twice a year or every six months, often used in the context of payments, interest accrual, or reporting periods.

Average Inventory

An accounting measure used to estimate the value or quantity of inventory over a period, typically calculated as the sum of the starting and ending inventory divided by two.

Beginning Inventory

The value of a company’s inventory at the start of an accounting period, before any purchases or sales have occurred.

Q8: On a TE-TP diagram consider a level

Q28: Which of the following Fed actions will

Q51: In which situation are transaction costs most

Q58: Taxable income rises by $2,500 and taxes

Q59: Which of the following statements is true?<br>A)Savings

Q68: Bank deposits at the Federal Reserve =

Q111: An open market sale by the Fed

Q120: In controlling the nation's money supply, the

Q126: Refer to Exhibit 9-1. The economy is

Q190: Which of the following is not an