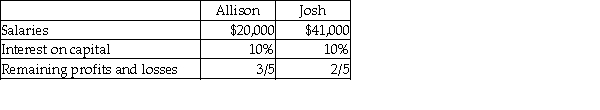

Allison and Josh are partners in a business. Allison's capital is $120,000 and Josh's capital is $120,000. Profits for the year are $80,000. They agree to share profits and losses as follows:  Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Definitions:

Home Depot

Home Depot is a large American home improvement retail chain that offers tools, construction products, and services across stores in the United States and beyond.

United States

A country located in North America, consisting of 50 states, and known for its large economy and diverse population.

Christmas Tree Shop

A retail store specializing in holiday decorations, particularly those related to Christmas.

Christmas Gifts

Items given to friends, family, and others as presents during the Christmas holiday season, often symbolizing affection and goodwill.

Q4: A long-term investment established to pay off

Q24: Sol and Joe are partners sharing profits

Q55: Which depreciation method does NOT use the

Q56: The last entry to liquidate a partnership

Q72: Which depreciation method deducts residual value when

Q90: Deposited cash in a bond sinking fund.<br>Debit

Q101: Identify each of the following transactions as

Q113: Sold treasury stock at a price below

Q116: The inventory method where items in the

Q144: The journal entry to record a loss