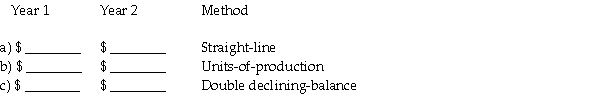

Bobson Company purchased a $60,000 machine on January 1. The machine is expected to have a useful life of 10 years or 60,000 operating hours and a residual value of $5,000. The machine was used for 6,000 hours in the first year and 4,400 hours in the second year. Compute the amount of depreciation expense for the first and second years under each of the methods below.

Definitions:

Argument Making

The process of constructing reasons, supported by evidence, to persuade others or to explain why a particular conclusion is valid.

Application Condition

Specific circumstances or requirements that must be met for a principle, law, or procedure to be applied.

Acceptance Condition

The circumstances or criteria that must be met for a proposal, hypothesis, or solution to be considered satisfactory or acceptable.

Premises

Statements or propositions from which conclusions are drawn or reasoned.

Q14: Gross Accounts Receivable is $23,000. Allowance for

Q62: After all liabilities have been paid, the

Q62: Paying the principal plus accrued interest.<br>Debit _

Q66: The proceeds received from discounting a note

Q72: Sold preferred stock at a price above

Q92: The entry to record the disposal of

Q93: What type of account is a Bad

Q94: Mack Industries uses the periodic inventory system.

Q114: What is the debtor's entry to record

Q114: The book value of an asset is