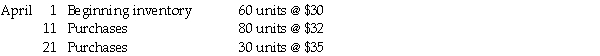

Calculate the ending inventory under each of the following methods given the information below about purchases and sales during the year. Assume a periodic inventory system. Round to four decimal places.  Sales for April: 115 units

Sales for April: 115 units

a) ________ FIFO

b) ________ LIFO

c) ________ Weighted-average

Definitions:

Operating Expenses

Operating Expenses are expenditures that a business incurs through its normal business operations, such as salaries, rent, utilities, and equipment depreciation.

Direct Method

A cash flow statement preparation approach that reports major classes of gross cash receipts and payments.

Cost of Goods Sold

An expense recorded to reflect the cost directly associated with producing the goods sold by a company.

Comparative Balance Sheets

Comparative balance sheets present the financial position of a company at two different points in time, allowing for analysis of changes and trends.

Q11: Mack Industries uses the perpetual inventory system.

Q13: The income statement columns on a worksheet

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q47: Interest due on a $26,000, 11%, 2.5-year

Q57: The allocation of the cost of a

Q60: The entry to record selling 2,000 shares

Q75: If a change is made in the

Q92: Reversing entries are done when assets or

Q105: Rental Income is what type of account?<br>A)

Q141: A car is purchased for $30,000 on