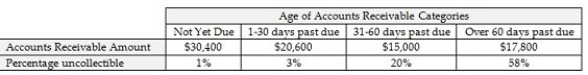

Prepare the adjusting journal entry for Bad Debts Expense from the following information using the balance sheet approach. The Allowance for Doubtful Accounts has a credit balance of $3,000.

Definitions:

Purchase of Stock

The act of buying shares in a company, either through a stock exchange or directly from the company.

Investing Activities

Financial transactions related to the acquisition or sale of long-term assets and other investments not considered as cash equivalents.

Statement of Cash Flows

A report detailing the impact of variations in balance sheet positions and income on cash and cash equivalents, segmented into operating, investing, and financing activities.

Increase in Accounts Receivable

A rise in the amount of money owed to the business by its customers for goods or services delivered.

Q7: The ending merchandise inventory was understated. This

Q20: Sam Moore purchased computer equipment for $6,000

Q46: Sam received $8,000 in advance for renting

Q53: For tax purposes, the gain or loss

Q53: The adjustment for accrued wages was NOT

Q75: Green Realty paid $6,000 rent on a

Q76: Lacy purchased equipment for $76,000 on January

Q82: When closing income statement accounts having credit

Q97: The entry to close the Freight-in account

Q134: A depreciation method that allocates depreciation of