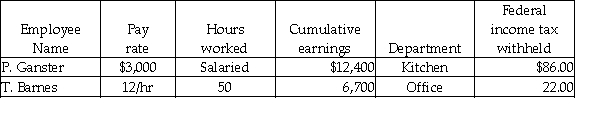

Grammy's Bakery had the following information before the pay period ending June 30:  Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

Definitions:

Financial Measures

Quantitative indicators used to assess aspects of a company's financial performance, such as profitability, liquidity, and solvency.

Advertising Expense

Costs incurred by a business to promote its products or services through various media channels.

Proportion

A part, share, or number considered in comparative relation to a whole.

Sales

Income received from selling goods or services over a period of time.

Q19: On February 12, Clare purchased $490 of

Q31: Why is beginning and ending inventory kept

Q48: The employer's annual Federal Unemployment Tax Return

Q77: Joe's Tax Service has two types of

Q95: Businesses will make their payroll tax deposits

Q96: A payment for $27 is incorrectly recorded

Q110: A form used to organize and check

Q110: Journalize the Nov. 7 transaction.<br>_ _ _<br>_

Q111: The credit recorded in the journal entry

Q113: Checks that have been processed by the