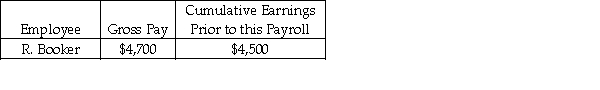

Jefferson Tutoring had the following payroll information on February 28:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

Definitions:

Cost Of Capital

The necessary yield a business needs to achieve on investment endeavors to preserve its market capitalization and secure capital.

Discount Rate

The interest rate used to determine the present value of future cash flows or to evaluate the attractiveness of an investment.

Opportunity Cost

The cost of an alternative that must be forgone in order to pursue a certain action, essentially the benefits you could have received by taking another course of action.

EVA

Economic Value Added, a measure of a company's financial performance based on the residual wealth calculated by deducting its cost of capital from its operating profit.

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q27: Beginning and ending inventories are $980 and

Q29: For each of the following, identify in

Q32: At the start of the year, Southern

Q77: Company policy for internal control should include

Q78: Any adjustment to the depositor's records because

Q80: Explain why the account Sales Tax Payable

Q88: If Wages and Salaries Payable is debited,

Q93: Which of the following accounts is a