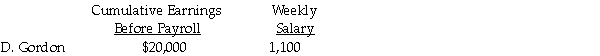

Sweeney's Recording Studio payroll records show the following information:  Assume the following:

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Each employee contributes $40 per week for union dues.

c) State income tax is 5% of gross pay.

d) Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry: for the payment of the above weekly salary only.

Definitions:

Inventory Management

The supervision of non-capitalized assets (inventory) and stock items, aiming to ensure the right products are in the right quantity for sale, at the right time.

Service Inventories

Assets held by a service business to support service delivery, including physical items, information, and capacities.

Cycle-Counting Personnel

Employees responsible for periodically counting inventory items to ensure accuracy without interrupting daily operations.

Inventory Holding Cost

The total cost incurred by holding inventory, including storage, insurance, spoilage, and opportunity costs.

Q18: Residual value is the:<br>A) estimated value of

Q57: The following normal account balances were found

Q63: The term used when the seller is

Q68: The entry establishing a $220 petty cash

Q73: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q74: Compute the employees' FICA-Medicare.

Q78: The controlling account is found in the

Q85: Jane works 45 hours at a rate

Q107: The use of a payroll register to

Q122: _ <br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt="_