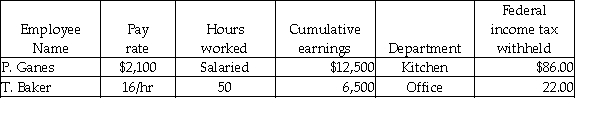

Grammy's Bakery had the following information for the pay period ending June 30:  Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

Definitions:

Street Addresses

A series of characters and numbers that specify a particular location within a city, town, or other areas, used for identifying or locating buildings.

Functional Resumé

A type of resume focused on skills and experiences rather than chronological work history, emphasizing the candidate's abilities.

Work History

A record of an individual's employment background, including positions held, durations of employment, and sometimes responsibilities and achievements.

Formal Education

Structured learning provided by educational institutions like schools and colleges, leading to recognized qualifications.

Q5: Determine the ending Capital balance of a

Q7: When you record the entry to the

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q25: The Freight-in account is an operating expense

Q39: On June 15, Melo Park purchased merchandise

Q49: Online Service received its telephone bill for

Q75: The drawee is the:<br>A) person who writes

Q91: Income Summary, before closing to Capital, contains

Q106: If the owner of Pastel Legal Services

Q125: Explain the purpose of workers' compensation, and