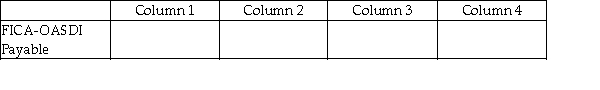

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

Definitions:

CGT

Capital Gains Tax, a tax on the profit realized on the sale of a non-inventory asset that was purchased at a cost amount that was lower than the amount realized on the sale.

Selling New Common Stock

The process whereby a company issues and sells additional shares of its common stock to investors to raise capital.

Cost of Equity

The return a company requires to decide if an investment meets capital return requirements and it can also be viewed as the risk-free rate of return plus a risk premium.

Capital Budgeting Projects

Capital budgeting projects are long-term investment decisions made by companies to invest in assets and projects for future growth and profitability.

Q16: If the Supplies account is NOT adjusted:<br>A)

Q20: Doug paid $3,000 on a one-year insurance

Q54: Employers pay the following payroll taxes:<br>A) FICA-OASDI.<br>B)

Q56: Wages and Salaries Payable would be used

Q72: FIT Payable has a credit normal balance.

Q87: Jim's Limousines' entry to establish a $160

Q93: Which of the following accounts is a

Q95: Businesses will make their payroll tax deposits

Q118: If $6,700 was the beginning inventory, purchases

Q131: Bob's Auction House's payroll for April includes