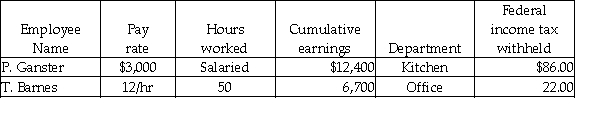

Grammy's Bakery had the following information before the pay period ending June 30:  Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

Definitions:

Customer

An individual or organization that purchases goods or services from another business.

Strategic Customer Relationship

The deliberate approach to managing a company's interactions with current and future customers to improve loyalty and engagement.

Preapproach

A preparatory stage in the selling process where a salesperson researches and plans strategies to approach potential customers.

Mental Steps

The cognitive processes involved in performing a task, making a decision, or solving a problem, often involving planning, reasoning, and memory.

Q7: Under the periodic inventory method, indicate the

Q12: A characteristic of the account, Sales Discount,

Q20: If cash flow is so important to

Q23: The journal entry to adjust the records

Q24: Gross Profit equals:<br>A) Net sales - Net

Q40: The Wages and Salaries Expense account would

Q75: The drawee is the:<br>A) person who writes

Q102: Closing entries will:<br>A) decrease the Owner's Capital.<br>B)

Q109: To examine in detail the weekly payroll

Q134: Gross Earnings are the same as:<br>A) regular