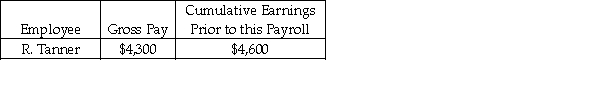

Mid-West Tutoring had the following payroll information on January 31:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Federal Income Tax Withheld $900; State Income Tax Withheld $300.

Using the information above, the journal entry to record the employee's payroll expense would include:

Definitions:

Perspective

A particular attitude toward or way of regarding something; a point of view.

Genetic Causes

Factors originating in an individual's DNA that contribute to the development of certain conditions or traits.

Intellectual Disability

A term used to describe a condition characterized by significant limitations in both intellectual functioning and in adaptive behavior, which covers many everyday social and practical skills.

Learning Disabilities

A variety of disorders that affect the ability to process, understand, or use information, impacting learning in individuals of normal or above-average intelligence.

Q1: What inventory method is used when the

Q26: A company would use a change fund

Q32: Which form is used to report FICA

Q37: The normal balance for Unearned Rent Revenue

Q48: Mortgage Payable is found on the balance

Q62: Of the following accounts, which might appear

Q82: _ <br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt="_

Q104: The W-3 is filed only for odd

Q108: The Merchandise account normally has a credit

Q113: _ <br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt="_