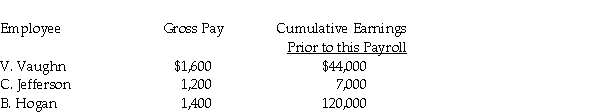

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Definitions:

Wear-and-tear Theory

A theory of aging that suggests that the body, like any machine, gradually wears out due to use over time.

Activity Theory

A theory that suggests older adults remain more satisfied and cognitively engaged when they maintain involvement with social and productive activities.

Adolescents

Refers to individuals in the developmental stage spanning the transition from childhood to adulthood, typically between the ages of 10 and 19, characterized by physical, emotional, and social changes.

Hobbies

Leisure activities voluntarily pursued for enjoyment, relaxation, or interest outside of one's professional or work-related duties.

Q9: Discuss the reasons a company would consider

Q19: Reduction given to company customers for early

Q23: The goal of closing entries does NOT

Q33: Prepare the necessary general journal entry for

Q52: On November 1, Call Center received $4,800

Q60: From the following items in the income

Q88: Prepare the necessary general journal entry for

Q93: Jack's Online Service on April 30 has

Q99: The Income Summary account shows debits of

Q112: Why would a business decide to use