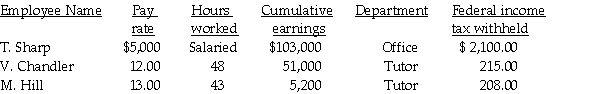

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total employer's payroll tax.

Definitions:

Withdraw

To remove funds from a bank account or investment.

Semi-Annually

Occurring or done every six months or twice a year.

Annual Payments

Payments made once a year as part of a financial agreement, such as loans, annuities, or investments.

Compounded Quarterly

Interest calculation method where interest is added to the principal sum at the end of every quarter, leading to interest earnings on interest.

Q7: Which of the following sequence of actions

Q28: There are 7 closing entries.

Q39: The same deposit rules apply to employers

Q40: The debit recorded in the journal to

Q55: Prepare the necessary general journal entry for

Q92: Determine the total cost of a purchase

Q93: The first two numbers of the ABA

Q98: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q107: Why are all of the employer payroll

Q111: Compute the employees' FICA-OASDI.