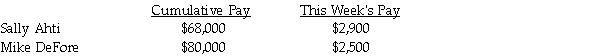

Compute the net pay for each employee. The FICA tax rate is: OASDI 6.2% on a limit of $128,400; Medicare is 1.45%; federal income tax is 15%; state income tax is 5%; and medical insurance is $100 per employee.

Definitions:

United States

A country in North America, consisting of 50 states, a federal district, five major self-governing territories, and various possessions.

Muller V. Oregon

Refers to a landmark Supreme Court case in 1908 that upheld Oregon's law limiting women's workday, establishing a precedent for using social science insights in legal rulings.

Unintended Consequences

Outcomes or effects that are not foreseen or intended by a purposeful action, often contrasting with the action's original goals.

Female Employees

Women who are employed in various sectors, highlighting their participation in the workforce.

Q4: The correct journal entry to record the

Q17: Recording to the accounts receivable subsidiary ledger

Q48: Betsy's Auction House's payroll for June includes

Q49: Office Supplies (not used for resale) bought

Q50: Financial statements are prepared from the:<br>A) trial

Q51: The worksheet is the first financial statement

Q54: The order of the steps to prepare

Q63: When making the adjustment for prepaid insurance,

Q77: Company policy for internal control should include

Q89: Equipment with a cost of $152,000 has