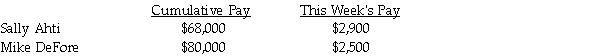

Compute the net pay for each employee. The FICA tax rate is: OASDI 6.2% on a limit of $128,400; Medicare is 1.45%; federal income tax is 15%; state income tax is 5%; and medical insurance is $100 per employee.

Definitions:

National GAAP

The set of accounting standards and principles recognized by a specific country to guide financial reporting and auditing.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that guide the preparation of financial statements globally.

International Financial Reporting Standards

A set of accounting standards developed by the International Accounting Standards Board (IASB) that is global in scope.

International Accounting Principles

Frameworks and rules for financial reporting that are accepted or practiced globally, designed to ensure transparency and comparability across international boundaries.

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q25: The entry to establish the petty cash

Q32: Which account is the controlling account for

Q32: If Prepaid Rent Expense for the period

Q44: Sales would be found on the worksheet

Q48: Which of the following would cause total

Q55: Which of the following taxes has a

Q66: A maximum earnings limit is set for

Q77: Joe's Tax Service has two types of

Q123: When the adjustment is made for depreciation,