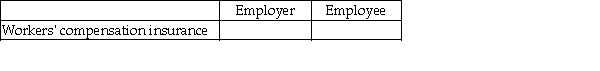

Given the following payroll items you are to identify whether they are the responsibility of the employer and/or the employee by placing an X in the appropriate column.

-

Definitions:

Net Income

The total earnings of a company after subtracting all expenses, including taxes and operating costs, from its total revenues.

Salary Allowances

Benefits or extra compensation provided to employees on top of their regular salary, often for specific purposes such as transportation, housing, or meals.

Original Investments

The initial capital outlay for an investment, not including any subsequent costs incurred or income earned from the investment.

Net Loss

The amount by which total expenses exceed total revenues in a business, indicating a financial loss over a specific period.

Q3: A FUTA tax credit:<br>A) is given to

Q4: The return of merchandise to the supplier

Q26: Purchase discounts are given to the buyer

Q32: An example of electronic funds transfer is:<br>A)

Q44: When closing the Income Summary account when

Q72: FIT Payable has a credit normal balance.

Q97: The liability account used to record sales

Q108: The original cost of equipment is reduced

Q113: Checks that have been processed by the

Q120: Define and discuss a calendar year, accounting