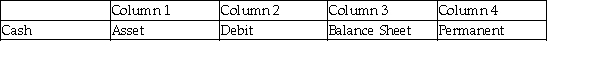

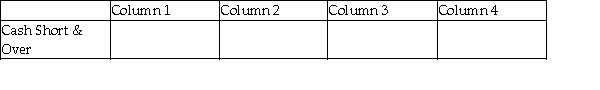

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

Example:

-

Definitions:

Handwriting Recognition

The ability of a computer to interpret and convert human handwriting into text or commands.

Document Management

Refers to the processes and practices used for managing, storing, and tracking documents within an organization.

Medicare CCI

Stands for Correct Coding Initiative under Medicare, which is designed to prevent improper payments where incorrect code combinations are billed.

Encoder Software

Computer software used to convert data into a particular format, often used for compressing video or audio data.

Q19: On February 12, Clare purchased $490 of

Q21: Wages and Salaries Expense is:<br>A) equal to

Q52: Determine the amount to be paid within

Q56: Endorsing a check:<br>A) guarantees payment.<br>B) transfers the

Q73: Sam purchased a four-year insurance policy for

Q102: A pay period is defined as:<br>A) weekly.<br>B)

Q107: The use of a payroll register to

Q116: When an asset expires or is used

Q121: Which of the following is a real

Q123: Interim statements are prepared to:<br>A) notify management