Short Answer

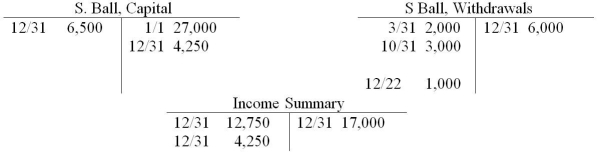

A summary of selected ledger accounts appears below for S. Ball for the current calendar year.  Answer the following questions.

Answer the following questions.

1. What was the total amount of withdrawals for the year?

2. What was the net income?

3. What was the total revenue?

4. What were the total expenses?

Definitions:

Related Questions

Q9: Employees must receive W-3s by January 31

Q40: After closing the revenue, expense, and withdrawal

Q83: The left side of the accounting equation

Q97: Which form contains information about gross earnings

Q97: What is the purpose of internal control?

Q99: Compute the total state income tax.

Q102: The dollar amount of the debits must

Q105: The bank charged another company's deposit to

Q107: If the debit and credit totals of

Q108: The journal entry to record a withdrawal